Renters Insurance in and around Phoenix

Looking for renters insurance in Phoenix?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

Your rented condo is home. Since that is where you make memories and kick your feet up, it can be a good idea to make sure you have renters insurance, especially if you could not afford to replace lost or damaged possessions. Even for stuff like your tools, furniture, laptop, etc., choosing the right coverage can insure your precious valuables.

Looking for renters insurance in Phoenix?

Coverage for what's yours, in your rented home

Agent Stephanie Chavez, At Your Service

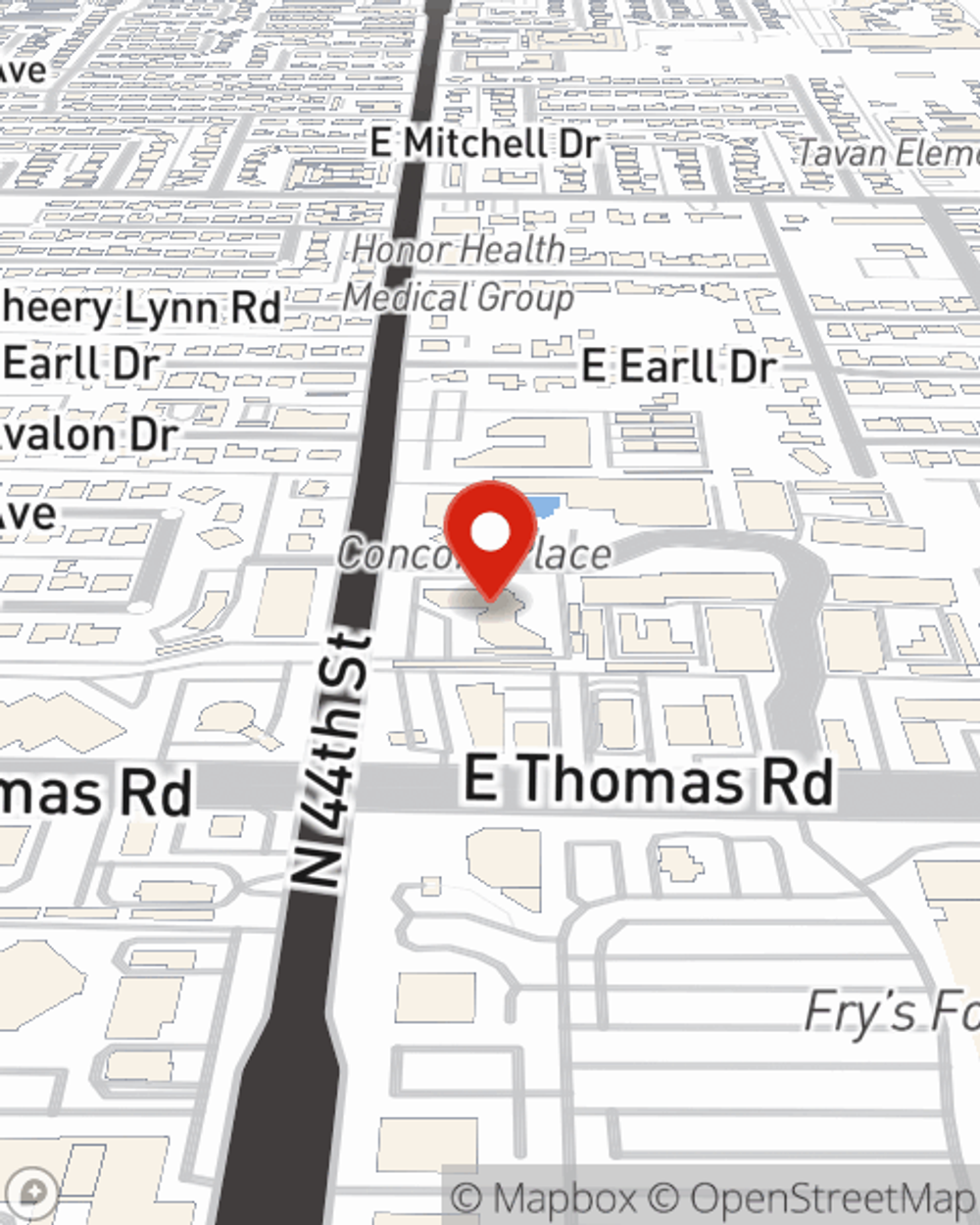

It's likely that your landlord's insurance only covers the structure of the property or space you're renting. So, if you want to protect your valuables - such as a video game system, a coffee maker or a cooking set - renters insurance is what you're looking for. State Farm agent Stephanie Chavez can help you evaluate your risks and protect your belongings.

A good next step when renting a home in Phoenix, AZ is to make sure that you're properly covered. That's why you should consider renters coverage options from State Farm! Call or go online now and see how State Farm agent Stephanie Chavez can help you.

Have More Questions About Renters Insurance?

Call Stephanie at (602) 457-3825 or visit our FAQ page.

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Stephanie Chavez

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.